Pvm Accounting for Dummies

Pvm Accounting for Dummies

Blog Article

Pvm Accounting for Dummies

Table of ContentsPvm Accounting Things To Know Before You BuyThe smart Trick of Pvm Accounting That Nobody is Talking AboutFascination About Pvm AccountingAll about Pvm AccountingThe 30-Second Trick For Pvm AccountingPvm Accounting for BeginnersThe Main Principles Of Pvm Accounting

In terms of a firm's overall method, the CFO is accountable for guiding the business to satisfy economic objectives. Some of these methods can entail the firm being acquired or purchases going ahead.

As an organization expands, bookkeepers can release up much more staff for various other company tasks. This could ultimately cause boosted oversight, greater precision, and better compliance. With more sources adhering to the route of cash, a service provider is far more likely to earn money accurately and on time. As a building and construction firm grows, it will require the aid of a full-time economic staff that's handled by a controller or a CFO to take care of the firm's financial resources.

10 Simple Techniques For Pvm Accounting

While large services may have full time financial backing groups, small-to-mid-sized companies can hire part-time accountants, accounting professionals, or monetary consultants as required. Was this article valuable? 2 out of 2 individuals discovered this practical You voted. Change your solution. Yes No.

As the building and construction industry remains to prosper, companies in this sector need to maintain strong monetary monitoring. Reliable bookkeeping practices can make a substantial difference in the success and growth of building and construction companies. Allow's check out five necessary accountancy practices customized especially for the construction market. By applying these methods, building and construction companies can improve their economic stability, enhance procedures, and make informed choices - construction bookkeeping.

In-depth estimates and spending plans are the backbone of building project administration. They help steer the project towards timely and rewarding conclusion while protecting the rate of interests of all stakeholders included. The vital inputs for job cost evaluation and spending plan are labor, products, tools, and overhead expenses. This is normally among the largest expenditures in building and construction jobs.

The 7-Second Trick For Pvm Accounting

An accurate estimation of materials needed for a task will aid guarantee the needed products are purchased in a prompt manner and in the right amount. An error right here can cause wastefulness or delays because of product lack. For the majority of building tasks, devices is needed, whether it is acquired or leased.

Correct equipment estimation will aid make sure the right equipment is available at the right time, conserving money and time. Do not fail to remember to make up overhead costs when estimating project costs. Straight overhead expenditures specify to a task and might include short-lived rentals, utilities, fence, and water supplies. Indirect overhead expenses are everyday prices of running your service, such as rental fee, administrative wages, utilities, taxes, devaluation, and advertising and marketing.

Another variable that plays right into whether a task is effective is an exact quote of when the task will be finished and the relevant timeline. This price quote helps make sure that a project can be completed within the assigned time and sources. Without it, a task might run out of funds before completion, causing possible job stoppages or desertion.

The Best Strategy To Use For Pvm Accounting

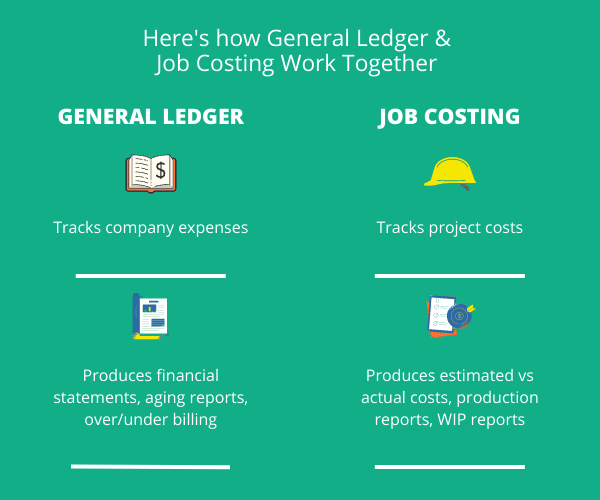

Accurate task costing can help you do the following: Understand the earnings (or do not have thereof) of each project. As work setting you back breaks down each input right into a task, you can track profitability separately. Contrast real expenses to quotes. Handling and evaluating price quotes allows you to better price work in the future.

By recognizing these items while the job is being completed, you prevent shocks at the end of the project and can attend to (and with any luck prevent) them in future jobs. An additional tool to help track jobs is a work-in-progress (WIP) schedule. A WIP timetable can be completed monthly, quarterly, semi-annually, or every year, and consists of task information such as agreement value, sets you back sustained to day, total estimated prices, and complete project invoicings.

Not known Incorrect Statements About Pvm Accounting

Budgeting and Forecasting Tools Advanced software program uses budgeting and projecting capabilities, permitting building firms to intend future projects extra accurately and handle their financial resources proactively. Document Monitoring Construction projects include a lot of documents.

Improved Vendor and Subcontractor Management The software can track and take care of repayments to suppliers and subcontractors, ensuring timely payments and maintaining great relationships. Tax Preparation and Filing Bookkeeping software application can assist in tax preparation and declaring, making sure that all appropriate economic activities are accurately reported and taxes are filed promptly.

Not known Details About Pvm Accounting

Our client is an expanding development and building company with head office in Denver, Colorado. With numerous active building work in Colorado, we are trying to find an Accounting Aide to join our group. We are seeking a full time Accounting Assistant that will certainly be click in charge of supplying functional support to the Controller.

Get and assess daily invoices, subcontracts, change orders, order, examine requests, and/or various other associated paperwork for efficiency and conformity with financial policies, treatments, spending plan, and contractual requirements. Precise handling of accounts payable. Enter invoices, accepted draws, purchase orders, and so on. Update regular monthly evaluation and prepares budget plan pattern records for construction projects.

Everything about Pvm Accounting

In this overview, we'll delve into various facets of building and construction accountancy, its value, the criterion tools utilized in this field, and its role in building and construction projects - https://yoomark.com/content/pvm-accounting-full-service-construction-accounting-firm-if-you-spend-too-much-time. From financial control and price estimating to capital administration, check out how bookkeeping can profit building and construction projects of all scales. Construction accountancy refers to the customized system and processes utilized to track monetary information and make calculated choices for construction organizations

Report this page